Bookkeeping Tips for Austin, TX Event Planners

Event Planning Business Bookkeeping Tips and Tricks:

Running a successful event planning business takes more than creative event concepts and satisfied clients. A well-designed chart of accounts with a numbering system tailored to event planners provides the financial clarity you need to track revenue, manage costs, and make confident business decisions.

Event planners juggle multiple revenue streams, including weddings, corporate events, social gatherings, consulting, and outsourced services. They also manage variable expenses like vendor payments, venue rentals, décor and supplies, software subscriptions, and staff overhead. Without a customized system, it’s hard to see which event types are truly profitable, manage cash flow wisely, or plan for seasonal demand.

As specialists in small business bookkeeping, we’ve helped event planning businesses implement numbering systems that deliver consistent, actionable financial insights. This guide shows you how to organize your chart of accounts so you can scale with ease.

Why Event Planning Businesses Need a Specialized Chart of Accounts

Generic bookkeeping templates fail to capture the financial nuances of event planning. Event planners benefit from categorizing:

Revenue from weddings, corporate events, and social gatherings separately

Vendor reimbursements vs. event planning service revenue

Payroll by role: event coordinators, assistants, designers

Software subscriptions (event management tools, scheduling apps, design software)

Deferred revenue from pre-paid bookings or deposits

These distinctions impact pricing, staffing, and tax planning. A structured system helps you answer questions like:

Are corporate events more profitable than social events?

Are vendor reimbursements skewing revenue reports?

Which service lines deserve more investment or marketing focus?

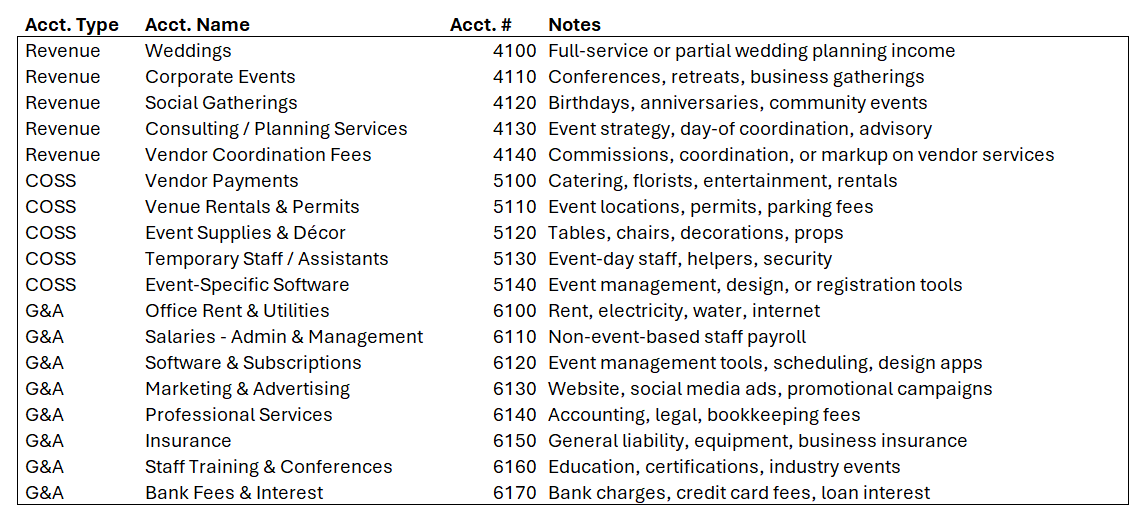

Standard Account Numbering Structure for Event Planning Businesses

A 5-category chart of accounts with tailored number ranges works well.

Leaving gaps between numbers (e.g. 4100, 4110, 4120) makes future additions easy and orderly.

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

Revenue Segmentation: Know What’s Really Driving Your Event Planning Business

One of the most powerful benefits of a tailored chart of accounts is separating and tracking different revenue streams. For event planners, this means going beyond a single “service revenue” account. You’ll want to distinguish between:

Weddings

Corporate events

Social gatherings (birthdays, anniversaries, community events)

Consulting or planning services

Vendor commissions or coordination fees

Tracking these separately gives you insight into what’s most profitable and consistent. For example, weddings may offer predictable high-value revenue, while corporate events create spikes that require higher upfront costs. Some planners also segment by service type - full-service planning, day-of coordination, décor, or entertainment coordination - to see which lines are performing best.

This lets you:

Adjust marketing focus based on profitability

Price premium services accordingly

Allocate team resources efficiently

Decide which offerings to scale or phase out

Expense Segmentation: Track Spending with More Clarity

Just like revenue, your event planning business’s expenses should reflect how your business actually operates. Break them into two main categories, Cost of Services Sold (COSS) and General & Administrative (G&A), for a clearer picture of profitability.

Cost of Services Sold (COSS)

Direct costs tied to client deliverables:

Vendor payments (catering, florists, entertainment)

Venue rentals or permits

Event-specific décor and supplies

Temporary staff or assistants

Event-specific software or design tools

General & Administrative (G&A) Expenses

Ongoing business costs that don’t vary much with project volume:

Office rent & utilities

Salaries for admin and management staff

Software & subscriptions (event management tools, scheduling apps, design software)

Marketing & business development

Professional services (accounting, legal)

Insurance

Staff training & conferences

Bank fees & interest

Categorizing this way allows you to measure profit margins per event type and control overhead more effectively.

Best Practices for Implementation

Leave room to grow: Use number intervals (e.g., 4100, 4200) so you can add new event types later without reorganizing your chart.

Train your team: Make sure anyone handling bookkeeping or invoicing knows how to code revenue and expenses correctly, especially for pre-paid events or deposits.

Software integration: Connect your invoicing or project management platforms (like QuickBooks, Dubsado, or HoneyBook) to your chart of accounts for smoother tracking.

Monthly reconciliation: reconcile bank statements, credit cards, and deferred revenue each month to stay accurate.

Common Mistakes to Avoid

Using a generic chart of accounts without industry customization

Mixing vendor reimbursements with service revenue

Combining all labor costs into one account instead of breaking out by role or event type

Not tracking profitability per service line

Letting your chart of accounts go stale as your offerings evolve

Conclusion

A well-structured chart of accounts with a numbering system built for event planning businesses gives you the visibility to:

Identify your most profitable services

Manage costs and vendors efficiently

Make informed hiring and investment decisions

Streamline tax reporting and forecasting

If you’d like a ready-to-use template or help customizing one for your event planning business, reach out. At For the Books, PLLC, we help small event planners simplify their finances so they can focus on creating unforgettable events - and growing their bottom line.

Disclaimer:

The information provided on this blog by For the Books is intended solely for general informational purposes and should not be construed as accounting, tax, legal, or professional advice. While we strive to provide accurate and timely content, every individual’s circumstances are unique. Therefore, you should consult with a qualified accountant, tax advisor, or other professional before taking any action based on the information presented here. For the Books expressly disclaims any liability for decisions made or actions taken based on this blog’s content.