Bookkeeping for Austin, Tx Photography Small Business Owners

Photography Business Bookkeeping Tips and Tricks:

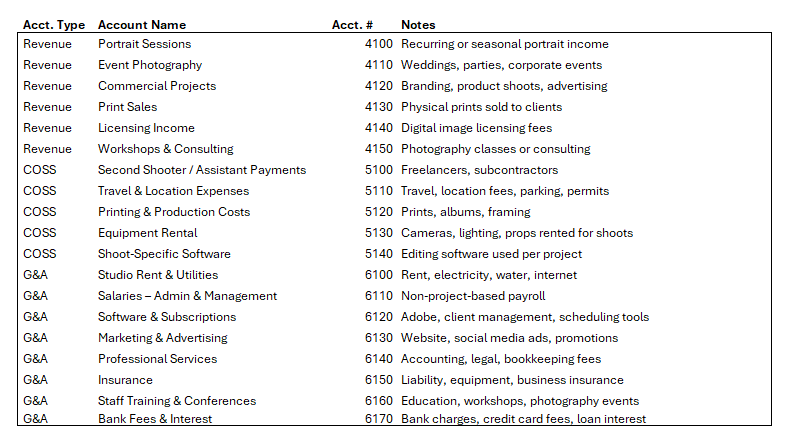

Running a successful photography business takes more than creative shoots and happy clients. A well-designed chart of accounts with a numbering system tailored to photography businesses provides the financial clarity you need to track revenue, manage costs, and make confident business decisions.

Photographers juggle multiple revenue streams, including portrait sessions, event photography, commercial projects, print sales, and licensing fees. They also manage variable expenses like equipment purchases, subcontracted second shooters, editing software subscriptions, and studio overhead. Without a customized system, it’s hard to see which services are truly profitable, manage cash flow wisely, or plan for slower seasons.

As specialists in small business bookkeeping, we’ve helped photography businesses implement numbering systems that deliver consistent, actionable financial insights. This guide shows you how to organize your chart of accounts so you can scale with ease.

Why Photography Businesses Need a Specialized Chart of Accounts

Generic bookkeeping templates fail to capture the financial nuances of photography work. Photography businesses benefit from categorizing:

Portrait session income separately from event or commercial project fees

Print sales and licensing revenue distinct from shoot services

Payroll or contractor payments by role - second shooters, editors, assistants

Software subscriptions (Adobe Creative Cloud, editing suites, client management tools)

Deferred revenue from pre-paid sessions or deposits

These distinctions impact pricing, staffing, and tax planning. A structured system helps you answer questions like:

Are weddings more profitable than commercial projects?

Are print sales or licensing fees skewing overall revenue reports?

Which services deserve more investment or marketing focus?

Standard Account Numbering Structure for Photography Businesses

A 5-category chart of accounts with tailored number ranges works well.

Leaving gaps between numbers (e.g. 4100, 4110, 4120) makes future additions easy and orderly.

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

Revenue Segmentation: Know What’s Really Driving Your Photography Business

One of the most powerful benefits of a tailored chart of accounts is separating and tracking different revenue streams. For photography businesses, this means going beyond a single “service revenue” account. You’ll want to distinguish between:

Portrait sessions (recurring or seasonal income)

Event photography (weddings, parties, corporate events)

Commercial or branding projects

Print sales or digital image licensing

Workshops, classes, or photography consulting

Tracking these separately gives you insight into what’s most profitable and consistent. For example, portrait sessions may offer predictable cash flow, while large commercial projects create revenue spikes but require higher upfront costs. Some photographers also segment by style or niche - weddings, lifestyle, commercial, product photography - to see which lines are performing best.

This lets you:

Adjust marketing focus based on profitability

Price premium services accordingly

Allocate time and resources efficiently

Decide which offerings to scale or phase out

Expense Segmentation: Track Spending with More Clarity

Just like revenue, your business’s expenses should reflect how your photography business actually operates. Break them into two main categories: Cost of Services Sold (COSS) and General & Administrative (G&A), for a clearer picture of profitability.

Cost of Services Sold (COSS)

Direct costs tied to client deliverables:

Payments to second shooters or assistants

Travel expenses and location fees for shoots

Printing and production costs

Equipment rentals for events or shoots

Shoot-specific software or editing costs

General & Administrative (G&A) Expenses

Ongoing business costs that don’t vary much with project volume:

Studio rent & utilities

Salaries for admin or management staff

Business software & subscriptions (Adobe Creative Cloud, client management, scheduling tools)

Marketing & business development

Professional services (accounting, legal)

Insurance

Bank fees & interest

Categorizing this way allows you to measure profit margins per service line and control overhead more effectively.

Best Practices for Implementation

Leave room to grow: Use number intervals (e.g., 4100, 4200) so you can add new services later without reorganizing your chart.

Train your team: Make sure anyone handling bookkeeping or invoicing knows how to code revenue and expenses correctly, especially for for pre-paid sessions or deposits.

Software integration: Map invoicing or client management software to your chart of accounts for automation.

Monthly reconciliation: Keep bank statements, credit cards, and deferred revenue accounts up to date.

Common Mistakes to Avoid

Using a generic chart of accounts without industry customization

Mixing print or licensing revenue with shoot services

Combining all labor costs into one account instead of breaking out by role or project type

Not tracking profitability per service line

Letting your chart of accounts go stale as your photography offerings evolve

Conclusion

A well-structured chart of accounts with a numbering system built for photography businesses gives you the visibility to:

Identify your most profitable services

Manage costs and contractors efficiently

Make informed pricing and hiring decisions

Streamline tax reporting and forecasting

If you’d like a ready-to-use template or help customizing one for your photography business, reach out. At For the Books, PLLC, we help small photography businesses simplify their finances so they can focus on creating stunning images, and growing their bottom line.

Disclaimer:

The information provided on this blog by For the Books is intended solely for general informational purposes and should not be construed as accounting, tax, legal, or professional advice. While we strive to provide accurate and timely content, every individual’s circumstances are unique. Therefore, you should consult with a qualified accountant, tax advisor, or other professional before taking any action based on the information presented here. For the Books expressly disclaims any liability for decisions made or actions taken based on this blog’s content.